Consumers are increasingly considering the environmental impact of the products and services they buy and are using sustainability claims to make purchasing decisions. With that, comes a temptation for businesses to overrepresents the extent to which their practices are environmentally friendly, sustainable, or ethical – and a growing concern by consumers, investors and regulators that some businesses are falsely promoting environmental or green credentials to cash in.

It’s difficult for consumers to verify the accuracy of a business’ environmental credentials. This increases the risk that consumers will be misled and that businesses trying to be genuinely “green” will be unfairly disadvantaged by higher costs of R&D and manufacturing, without any corresponding marketing advantage.

Claims of greenwashing are now a feature of the Australian business landscape and our regulators are sitting up and taking notice.

AUSTRALIAN COMPETITION AND CONSUMER COMMISSION

The ACCC’s compliance and enforcement priorities have placed a strong focus on targeting claims in relation to environmental and sustainable practices. The ACCC’s concerns about greenwashing are –

- It limits a consumer’s ability to make informed choices

- It leads consumers to pay more for the value of an environmental benefit that doesn’t exist

- It unfairly disadvantages businesses that can legitimately claim to provide more sustainable products or services, and

- It undermines consumer trust in environmental claims and can create a disincentive for businesses to invest in more sustainable practices.

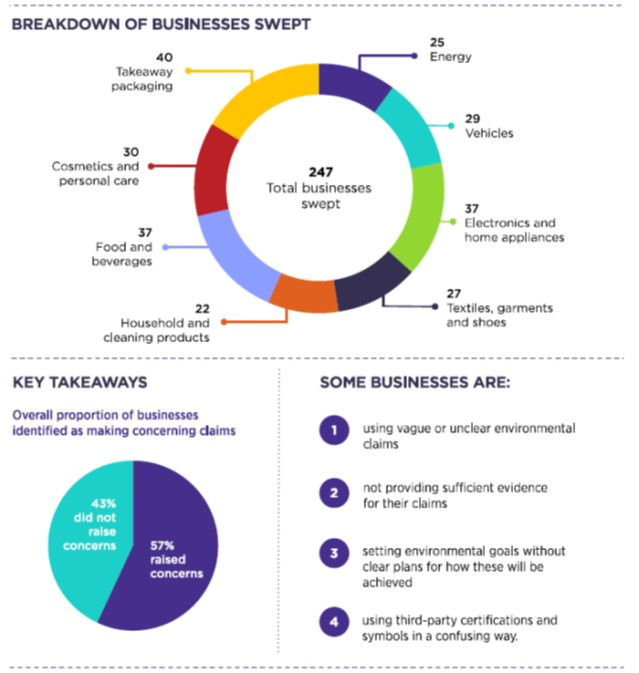

The ACCC released a report in March 2023, setting out the findings of its internet sweep of environmental claims. A snapshot of its findings (taken from the report) is set out below. Concerningly, it found that 57% of the businesses it reviewed caused concerns for the ACCC about the claims that were being made.

Greenwashing claims are not new to the ACCC. It has previously brought enforcement action when it considered marketing claims did not align with the products being sold:

- In 2007, the ACCC prosecuted G.O.Drew for supplying inorganic eggs while representing them as certified-organic – the company was ordered to pay a fine of $25,000;

- In 2018, the ACCC prosecuted GAIA Skin Naturals for false or misleading representations in relation to its claims that its baby care products were pure, natural and organic, when in fact they contained two synthetic chemical preservatives – the company was required to pay a fine of $37,800; and

- In 2016, the ACCC brought proceedings against Volkswagen AG in relation to the diesel-gate emissions scandal (its diesel vehicles did not comply with environmental standards and should not have been sold in Australia), where the Court imposed a record $125 million penalty. Volkswagen’s appeal to the High Court about the amount of the penalty was dismissed in 2021.

The ACCC is looking at the overall impression created by statements made and images used by an entity about its products and services, and whether any logos or endorsements are clear. Unsubstantiated claims that mislead a consumer into thinking a company’s practices are environmentally friendly may result in ACCC enforcement action.

AUSTRALIAN SECURITIES & INVESTMENT COMMISSION

ASIC might have been a little late to this party, but it’s making up for lost time. Action against greenwashing is one of ASIC’s 2023 enforcement goals.

MERCER

In February 2023, ASIC launched its first court action alleging greenwashing conduct against Mercer Superannuation (Australia) Limited (Mercer) for allegedly making misleading statements about the sustainable nature and characteristics of some of its superannuation investment options.

ASIC alleges Mercer made statements on its website about sustainable investment options offered by it, saying the product was suitable for members who ‘are deeply committed to sustainability’ because they excluded investments in companies involved in carbon intensive fossil fuels like thermal coal. Exclusions were also stated to apply to companies involved in alcohol production and gambling. However, ASIC alleges members who took up the sustainable option had investments in companies such –

- 15 companies involved in the extraction or sale of carbon intensive fossil fuels (including AGL Energy Ltd, BHP Group Ltd, Glencore PLC and Whitehaven Coal Ltd);

- 15 companies involved in the production of alcohol (including Budweiser Brewing Company APAC Ltd, Carlsberg AS, Heineken Holding NV and Treasury Wine Estates Ltd); and

- 19 companies involved in gambling (including Aristocrat Leisure Limited, Caesar’s Entertainment Inc, Crown Resorts Limited and Tabcorp Holdings Limited).

VANGUARD

In July 2023, ASIC started court proceedings against Vanguard Investments Australia (Vanguard), alleging misleading conduct insofar as Vanguard had claimed that all securities in its ethical fund were screened against certain ESG criteria.

Vanguard claimed it excluded issuers with significant business activities in a range of industries, including those involving fossil fuels. Those claims were made in the product disclosure statement, in media releases, on its website and at events that were recorded and published online. However, ASIC alleges that ESG research was not conducted over a significant proportion of the fund, and many of the issuers violated the ESG criteria, exposing investors to investments which had ties to fossil fuels, including oil and gas exploration.

ASIC said ‘We know that investors are increasingly seeking investment options that exclude certain industries, and investors need to be able to rely on investment screens to help them make these choices. We consider that the screening and research undertaken on behalf of Vanguard was far more limited than that being promised to investors, and we consider this constitutes another example of greenwashing.’

ACTIVE SUPER

In August 2023, ASIC commenced court proceedings against LGSS Pty Limited (Active Super) alleging misleading conduct and misrepresentations to the market relating to claims it was an ethical and responsible superannuation fund.

Active Super represented on their website that they eliminated investments that posed too great a risk to the environment and the community, including tobacco manufacturing, oil tar sands and gambling. Active Super also stated that they had added Russia to their list of excluded countries, following the invasion of Ukraine. The ESG representations were made on Active Super’s website, disclosure documents and on Facebook, Instagram and LinkedIn.

However, ASIC alleges that Active Super held numerous holdings which exposed members to securities it claimed to restrict, including –

- Gambling: Skycity Entertainment Group Limited, PointsBet Holdings Limited, The Star Entertainment Group Limited, The Lottery Corporation Limited and Tabcorp Holdings Limited;

- Tobacco: Amcor PLC;

- Russian entities: Gazprom PJSC and Rosneft Oil Company;

- Oil Tar Sands: ConocoPhillips;

- Coal Mining: Coronado Global Resources Inc., New Hope Corporation Limited and Whitehaven Coal Limited.

In a statement, ASIC said “There is much competition among super funds for new members, and we know that funds seek to attract members with promises their investments will not be exposed to certain industries. When making these claims super funds must have evidence to back their claims and ensure they are not promising exclusions that they cannot guarantee.”

As is evident from the cases above, ASIC has committed to targeting misleading ESG claims relating to financial products and with that in mind, it has been conducting a review of managed investment and superannuation funds that offer ‘ESG’ or ‘green’ products to ensure the claims are correct. ASIC has encouraged providers of financial products to look out for any greenwashing – and to ask whether their company’s disclosure around environmental risks and opportunities, or their promotion of ESG focused products, accurately reflects their practices in this area.

Sarah Davies

Director

Sarah Davies Legal

Accredited Specialist – Commercial Litigation

This article is produced as general information in summary for clients and should not be relied upon as a substitute for detailed legal advice or as a basis for formulating business or other decisions. Formal legal advice should be sought in relation to particular matters. Sarah Davies Legal Pty Ltd asserts copyright over the contents of this document.